By Ahmed Khan

Variances in Manufacturing costs from Bid are realized upon completion of deliverables. The financial impact of this delay in processed information can potentially have a significant impact to an entity’s bottom line for that reporting period. This can not only have negative connotation on financial positions but also imply lack of cost control within an organization.

Background and Context

When a customer opens a Tender for bidding, even though these are highly engineered and customized deliverables – Vendors typically use historical data with similar requirements to populate the cost base of a tender to place the bid within a short amount of time they are given.

Once a project is won, the Operations team takes the lead and day 1 financial position is set up using the details provided by the tendering team. ERP systems are updated, and Engineering teams get to work in order to generate designs and specifics needed for the manufacturing side to initiate production cycles.

These cost assumptions are then carried until parts are actualized upon which the variances are taken into account, margins are updated, and the impacts recorded. The time between initial cost assumptions and realization of actual cost could range between 6 months to a year depending on the lead time for various products and businesses. This delay of actualizing costs combined with the magnitude of change, could have significant consequence for an organization’s bottom line.

Importance of Information Accuracy

Cost control is one of the most important aspect of any manufacturing environment. It’s imperative that process efficiencies are implemented throughout the value chain in order to improve the bottom line. They key however, is not only controlling the cost – but also accurately forecasting it. In order to fully comprehend the complexities behind the need to forecast and control cost – we need to understand the concept of Blended Margin Reporting.

The basic idea behind BM reporting is removing monthly unpredictability of Margin % for a project that has multiple types of deliverables with varying margins. It helps understanding project progression and improves forecasting accuracy at a macro level.

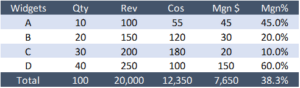

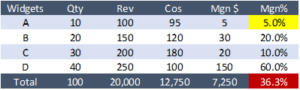

As an example, assuming a company manufactures 4 different types of Widgets for a project. Each widget has its specific Cost, Price point, Quantity and margin %.

Consolidated project margin is 38.3%.

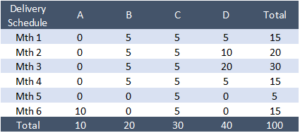

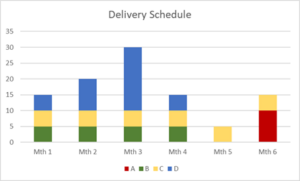

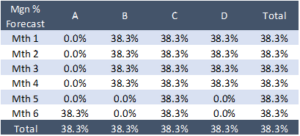

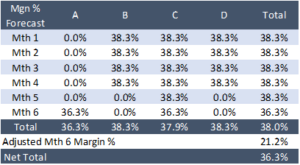

Let’s assume a delivery schedule of 6 months for all these widgets. Based on which we can populate a cost forecast that will hit our monthly P&L.

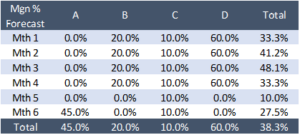

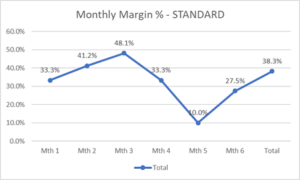

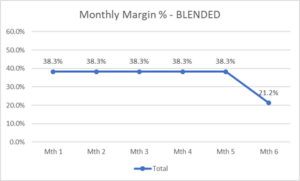

Let’s assume a delivery schedule of 6 months for all these widgets. Based on which we can populate a cost forecast that will hit our monthly P&L. If we follow the standard form of reporting, we will see the monthly margin % varying greatly – even though upon completion – the overall project margin will be accurate. This monthly swing can be quite significant depending on innumerable variables throughout the life of project.

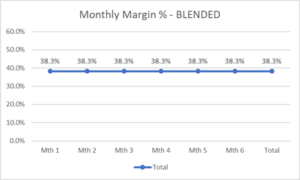

To mitigate the variability, corporations now use a Blended Margin reporting format. Using this model, every deliverable will be recognized at the OVERALL project margin % irrespective of its original specific rate. That enables a consistent monthly report ensuring forecasting accuracy, irrespective of any change in manufacturing or delivery schedules.

And this is where – any change in Cost and the timing of that information becomes extremely important.

As per the schedule – Widget A is expected to deliver in Month 6. Let’s assume, it required additional cost to complete, thereby lowering the overall project margin. Moreover, the increased cost is discovered upon completion of the Widget.

In order to complete the project at the revised lower margin %, Month 6 will have to account for an Inception to date adjustment and report out at a significantly lower margin to compensate for all the previous 5 months. In this example, Month 6 will end up at 21.2% in order to show total project margin reported at the revised 36.3%.

This impact could have been avoided if we had known about the requirements earlier that resulted in Widget A being manufactured at a higher cost. That change would have been considered from the get-go, and our monthly margin % reported would be at 36.3%. This would eliminate the need to make large adjustments and having to absorb the impact to the bottom line on monthly financials.

Issues and Challenges

Issue 1:

Inaccurate cost forecasting at the Tendering stage that lays the foundation of the issue at hand.

Challenges:

The biggest challenge in improving cost forecasts at the tendering stage is lack of time to do proper research and gather input from Engineering or Manufacturing teams. Hence the reliance on comparative analysis tools and processes.

Issue 2:

Unavailability of accurate costing early enough to mitigate late blending adjustments.

Challenges:

Multiple pieces of information involved in the cost basis for a manufactured element makes predicting or projecting actual costs extremely difficult. There are three main drivers of cost – Direct Material, Direct Labor and 3rd Party costs. A significant amount of manual processing is involved to extract the data for all three drivers and then consolidate and compile this information to form a cost base.

Solution

The solution to mitigating cost control issues lies within finding the right tool:

- The right tool must enable the customer to generate accurate forecasts and improved timelines.

- The right tool must be able to apply complex assumptions based on variable data sets that not only provide consistent and precise results, but do so at a much earlier stage without the need of details from an organization’s supply chain. The

- The right tool must be able to held clean and standardize the data, specially as data is gathered for relativity and comparative analysis. The value generated from data will be higher if its managed and clean.

Data ConnecXion is focusing on creating the right tool to help mitigate cost control issues. Contact us to find out more.